Navigating NYC’s Real Estate Storm: Insights into the Toughest Market Since 1995

Like the global economy, the New York City real estate market is also experiencing turbulence.

The data for 2023 reveal a drop in residential real estate sales in New York City and a significant decline in interest in commercial real estate, primarily in office space.

As a result, the average number of days a property spent on the market has also increased.

In 2022, there was a nationwide decline in real estate sales across the United States, a trend that persisted in nearly all regions, including New York City, throughout 2023. Sales in 2023 fell 18% compared to 2022. It was the slowest year for sales since 1995.

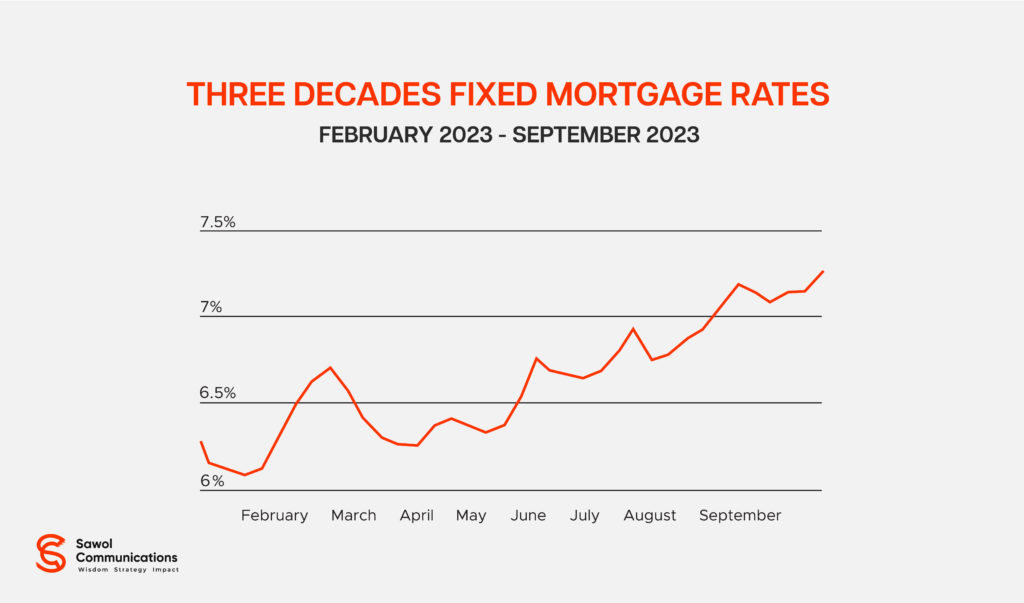

Experts partly attribute this trend to the highest mortgage rates in the last 30 years.

High mortgage rates are certainly a key factor in this scenario. However, they are not the only ones. The rise of remote work during the pandemic has sharply reduced demand for commercial real estate in NYC. In addition, the high cost of rent, concerns about safety, and the ability to work remotely have prompted thousands of New Yorkers to look toward other cities and even states.

Considering all these factors, it's clear that challenging times lie ahead for New York real estate developers. The slowdown in sales and a marked decrease in demand for luxury and high-end residential and commercial real estate, along with a considerable increase in the average number of days that property spends on the market, promises financial losses, a decline in transactions, and consequently, mass layoffs for companies operating in New York City.

What should developers and real estate agencies do in such a situation? One option is to wait out the difficult times; another is to actively attract potential foreign investors/buyers who want to diversify their portfolios and search for a safe haven for investment.

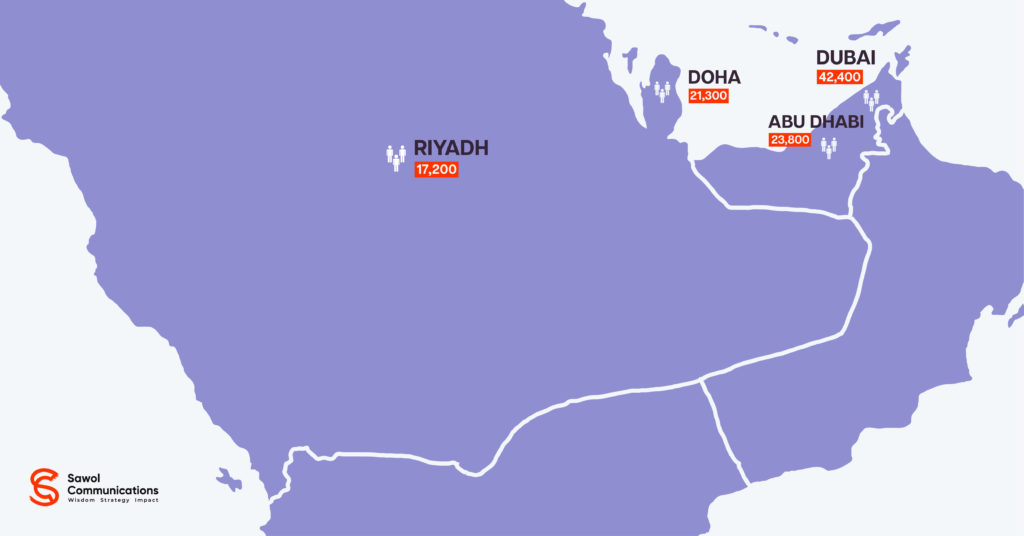

In this regard, we would advise turning your attention to the GCC countries. Relatively stable oil prices over the past three years, as well as the transformation of cities such as Dubai, Doha, and Manama into regional and, to a certain extent, global financial centers, have led to a significant flow of financial resources, resulting in a substantial influx of financial resources, totaling hundreds of billions of dollars.

Some statistical information about the region. In 2022, against rising prices for energy resources, the GDP growth of the GCC countries amounted to 7.3%; the total GDP amounted to $2.4 trillion.

The region is home to many local and foreign high-net-worth individuals. For example, there are 42,400 millionaires in Dubai, 23,800 in Abu Dhabi, 21,300 in Doha, and 17,200 in Riyadh.

Given geopolitical risks and the desire of corporate and individual investors to diversify their portfolios, New York real estate developers can offer suitable investment solutions to potential buyers and investors.